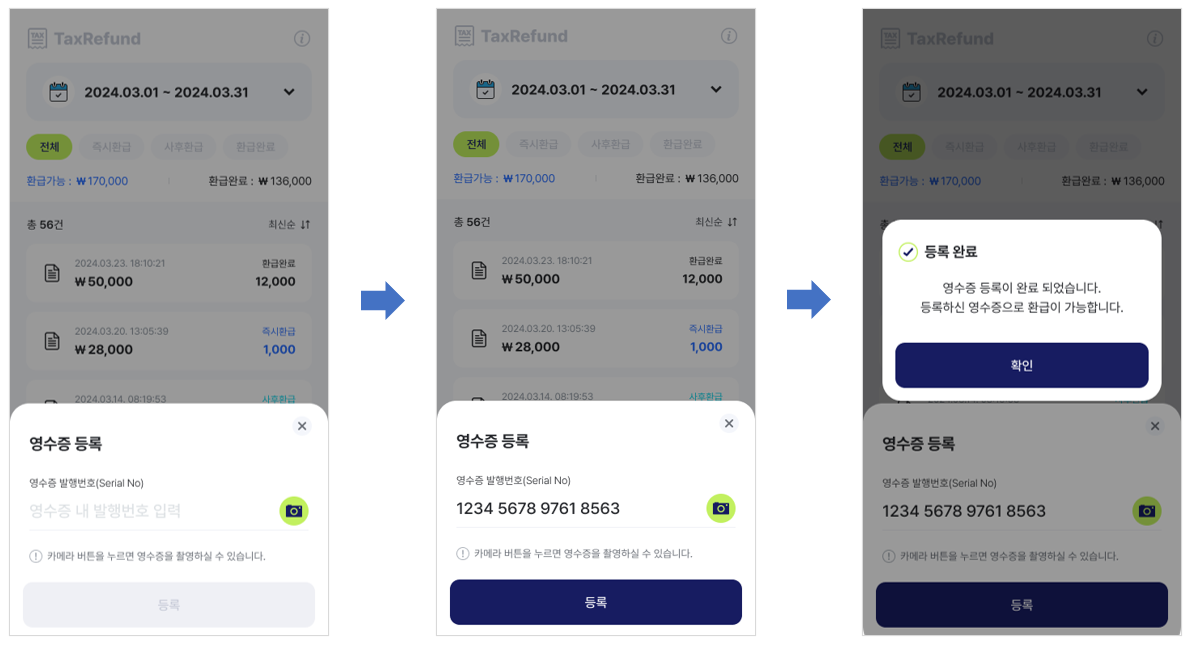

Pre-register Tax Receipts on Mobile for Export Verification

🧾What is pre-registering tax receipts on mobile for export verification?

👉🏻

When leaving the country with purchased items, there is no need to wait in line at the airport KIOSK. You can simply apply for export verification through your mobile device with customs.

🙋♀️ Tax Refund Eligibility

- Foreigners staying in Korea for less than 6 months.

- Overseas Koreans staying in Korea for less than 3 months

and having lived abroad for more than 2 years.

👀 How to Use Mobile Export Verification

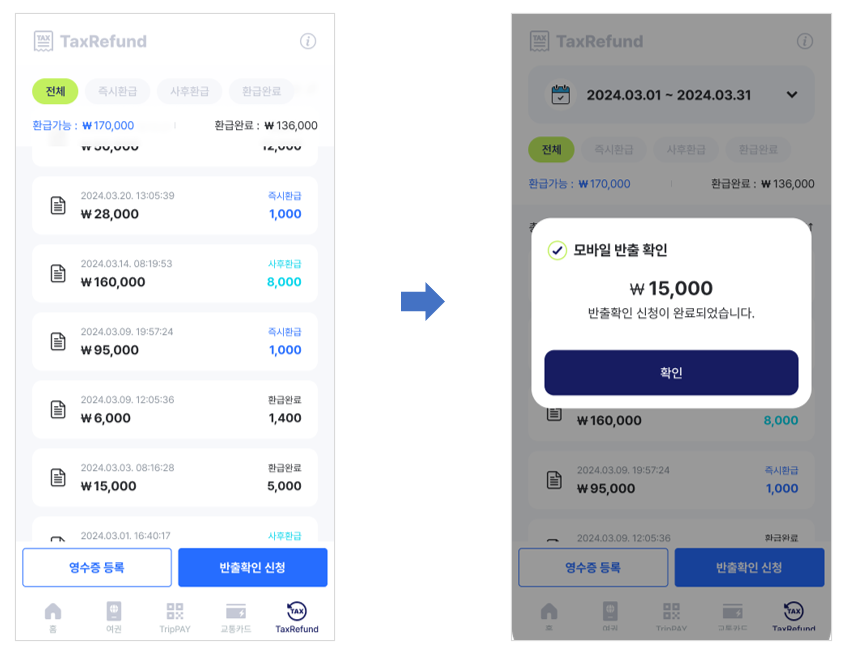

※ step 2 - Apply for Export Verification:➊ After connecting to the airport Wi-Fi, select [Apply for Export Verification].

➋ Complete customs export verification for purchases eligible for post-refund.

* If a message appears requiring customs verification, be sure to bring the purchased items to customs for stamping.

✅ Key points you must check!

- Only LORDSYSTEM tax refund slips are eligible for use.

- Upon arriving at the airport, please connect to the airport Wi-Fi.

- If approval is not granted, please visit customs, present the purchased items, and obtain a customs stamp.